top of page

Volatility Trading Strategies

Search

Video #123) VXX is NOT broken

One of the most important aspects of successfully trading volatility ETPs is to actually understand how they work and the mechanism as to...

Brent Osachoff

Sep 7, 20201 min read

Video #122) BIG Short Volatility Profit, unless...

The relationship between the VIX futures and the VIX index are stretched to the extreme, which under the right conditions may mean profit...

Brent Osachoff

Aug 30, 20201 min read

Article #598) Short Volatility (short VXX) performance within different volatility ranges

Continuing on with the theme for the week, which is all about the VB Threshold strategy and its leveraged alternative, I want to discuss...

Brent Osachoff

Aug 20, 20204 min read

Video #121) Leveraged VB Threshold strategy - 40% / year

For investors with a higher level of risk tolerance, they may want to take the already killer VTS VB Threshold strategy and add a little...

Brent Osachoff

Aug 18, 20201 min read

Article #597) General Volatility metrics dashboard - Short Vol bias, percentile, median

I have updated the General Volatility metrics data table to be the same as the Specialty Volatility metrics table above it. Just keeping...

Brent Osachoff

Aug 12, 20204 min read

Article #596) Volatility Barometer - % of days in each "decile" range

The VB Threshold strategy has moved into SVXY for the first time in several months. That means we're now in the 20-40% range of the...

Brent Osachoff

Aug 10, 20203 min read

Article #595) VXX Puts & Calls vs Short VXX - How has each done since Feb 18'?

It's been a little while since I last addressed the "VXX Puts vs Short VXX" question so let's revisit this today. That is to say, which...

Brent Osachoff

Aug 3, 20204 min read

Article #594) VTS Tactical Volatility strategy - Trade profit/duration data study

Today is day 7 for our Long VXX Put position within the Tactical Volatility strategy. It was initiated on July 17th and we're still...

Brent Osachoff

Jul 27, 20205 min read

Article #593) All 4 strategies are positioned aggressively, finally!

VTS Community, As of yesterday we have all 4 of our strategies in what are considered aggressive positions, finally! This alignment of...

Brent Osachoff

Jul 21, 20203 min read

Video #120) Introducing MSVX - A new volatility ETF

Let's talk about the new volatility ETF called MSVX, it's bias, performance, and what type of investor this thing may be suitable for....

Brent Osachoff

Jul 9, 20201 min read

Video #119) TVIX is being delisted - What now?

It was a good 10 year run for old TVIX, but its day has finally come. TVIX will be delisted. Let's talk about why and what it means for...

Brent Osachoff

Jul 1, 20201 min read

Video #118) Here's why VIX Put Options don't work

In this video we examine the effectiveness of the strategy of waiting for the VIX index to spike up higher, and then buying Put Options...

Brent Osachoff

Jun 24, 20201 min read

Video #117) Robinhood Tragedy - 5 ways to protect yourself

There was a very tragic incident involving a young trader using the Robinhood investing platform, where he was shown a negative balance...

Brent Osachoff

Jun 21, 20201 min read

Article #592) Can VIX futures Contango / Backwardation "time" the S&P 500?

I've made no secret of the fact that I believe the most important aspect of long term investing is avoiding excessive drawdowns. ...

Brent Osachoff

Jun 17, 20204 min read

Video #116) Leveraged Defensive Rotation strategy

As a more conservative investor, I've always focused on giving people the smoothest investing experience possible. This has meant that...

Brent Osachoff

Jun 10, 20201 min read

Video #115) Leveraged Tactical Balanced strategy

The Tactical Balanced strategy has been in the Total Portfolio Solution since it launched in January 2012 and has demonstrated very low...

Brent Osachoff

May 28, 20201 min read

Article #591) Where did contango go? VIX futures expiration cycle example

I get a lot of people asking how to calculate VIX contango and why it sometimes makes big changes day to day. Since we saw a big change...

Brent Osachoff

May 20, 20204 min read

Article #590) Defense at the cost of offense? - TPS top 10 gains and losses

VTS Community, One of the core principles in my overarching investing philosophy is that I believe it's far more important to be...

Brent Osachoff

May 18, 20203 min read

Video #114) Don't buy TVIX - It's highly leveraged and risky

In this video we look at TVIX performance, it's leverage factor, and how it functions in an attempt to finally convince people that...

Brent Osachoff

May 12, 20201 min read

Video #113) Buy & hold Short Volatility does not work, here's why

Let me explain why neither Long Volatility nor Short Volatility are effective buy & hold trades in the long run. Want to join the Awesome...

Brent Osachoff

May 10, 20201 min read

Video #112) Watch this before adding leverage to trading - Risk management

The allure of big profits causes a lot of people to leverage up their trades without fully understanding that leverage is a two way...

Brent Osachoff

Apr 26, 20201 min read

Article #589) Read this before considering adding leverage to VTS strategies

Due to the sheer number of questions I get regarding adding leverage to the VTS strategies, I will (reluctantly) add leveraged...

Brent Osachoff

Apr 21, 20205 min read

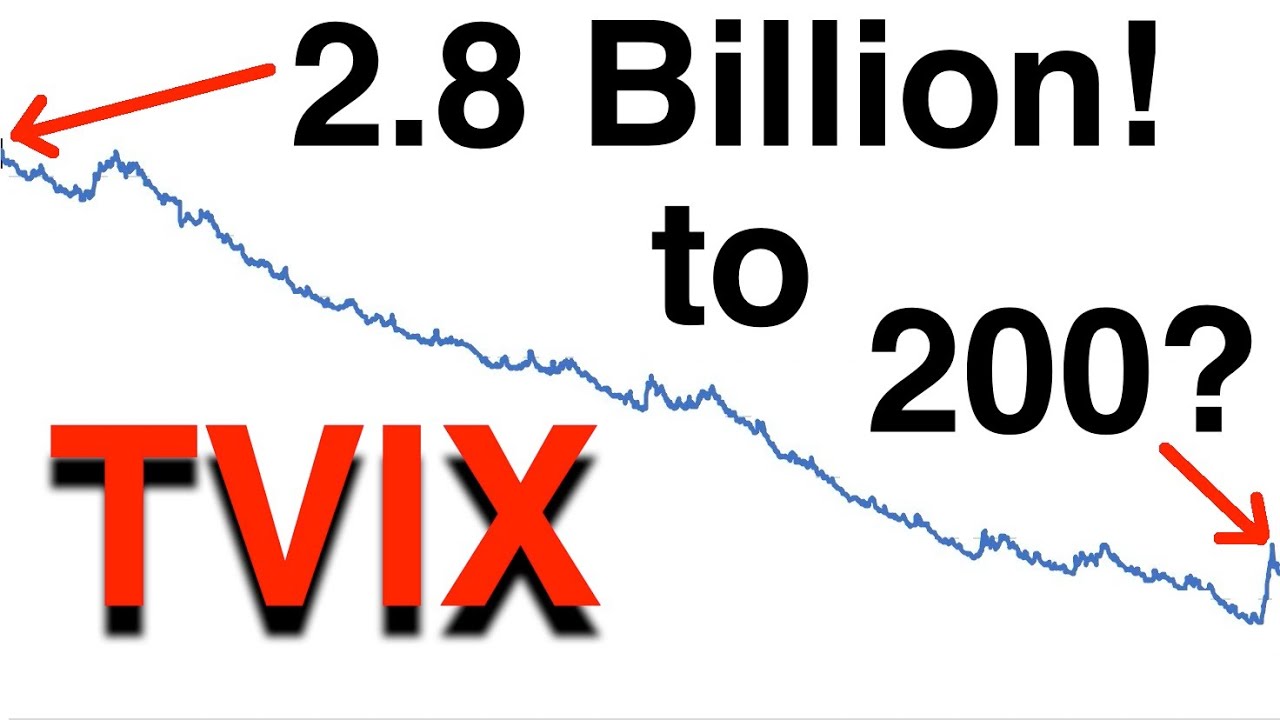

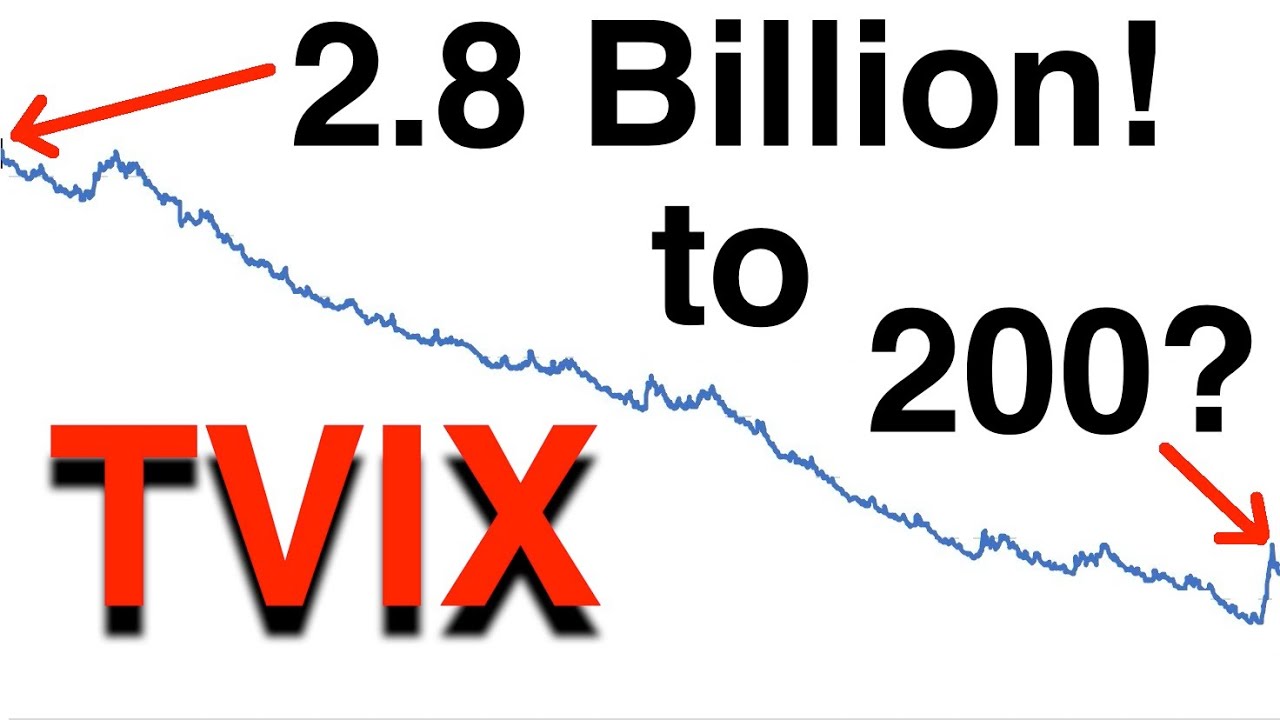

Video #111) Did TVIX go from 2.8 billion to 200? Here's why it'll never hit all time high

If you look at charts of the 3 main Long Volatility ETPs, TVIX, UVXY, and VXX have all gone from extremely high levels in the past to...

Brent Osachoff

Apr 19, 20201 min read

Article #588) Short S&P 500 instead of Gold?

Question: Why don't you short the S&P 500 instead of buying Gold? (VTS Tactical Balanced strategy) This question is most commonly asked...

Brent Osachoff

Apr 17, 20205 min read

bottom of page