top of page

Volatility Trading Strategies

Search

Video #180) Live Short VXX Options Trade for the Broken VXX

Barclays has suspended share creations on the VXX which means it's not tracking it's indicative value anymore, it's broken! This kind of...

Brent Osachoff

Mar 23, 20221 min read

Video #179) VXX is Broken! Don't Trade VXX Until You Watch This

The VXX is Broken! Barclays Bank has halted share creation on VXX, which means it will very likely deviate substantially from the...

Brent Osachoff

Mar 17, 20221 min read

VTS Livestream #34) Top 6 VXX Options Trades While VXX is Broken

We don't know how long the share creation in VXX will be halted, so in this livestream we talked about 6 options trades (3 short and 3...

Brent Osachoff

Mar 16, 20221 min read

VTS Livestream #33) VXX Is Broken! - Barclays bank has halted share creation

Barclays Bank has halted share creation with VXX, which means it will likely deviate substantially from its indicative value. In this...

Brent Osachoff

Mar 15, 20221 min read

Video #178) Here's What VIX Index Values Actually Mean - Estimate Forward S&P 500

The VIX Index is one of the most quoted and referenced index in the investing world. But do people really know what it is? When the VIX...

Brent Osachoff

Mar 13, 20221 min read

VTS Livestream #32) Why is UVXY Down When Stocks Are Also Down?

In this livestream we discussed what actually causes UVXY and VXX movements, and I explain how UVXY still went down when the S&P 500 went...

Brent Osachoff

Mar 11, 20221 min read

Video #177) What is Beta? - Stocks Direction & Magnitude - Volatility Lingo Ep.7

Beta is one of my favourite metrics because it gives us valuable information on two important factors: Direction & Magnitude. Here's...

Brent Osachoff

Mar 9, 20221 min read

Video #176) VTS is 10 Years Old! Performance Review & the Future

VTS just crossed the 10th anniversary since I launched back in January 2012. Thanks to everyone for all the support over the years, and...

Brent Osachoff

Feb 27, 20221 min read

Article #637) What is the Ideal "Long Volatility" Trade Frequency for Tail Risk?

VTS Community, We've dedicated three blogs in the last several weeks talking about the bizarre nature of this market sell off. More...

Brent Osachoff

Feb 24, 20226 min read

Article #636) Part 2 - 5 Volatility Ranges - Our Beta : SPX Exposure During Each

VTS Community, In Part 1 of this article yesterday (read Part 1 here if you missed it) we talked about why "Buy and Hold" investing is...

Brent Osachoff

Feb 17, 20227 min read

Article #635) Part 1 - 5 Volatility Ranges - Our Expected Portfolio Positions During Each

VTS Community, The vast majority of the investment world is what we would consider buy and hold investors. Now it's hard to put an exact...

Brent Osachoff

Feb 16, 20226 min read

Video #175) VTS Performance Score - Risk vs Reward metric better than the Sharpe Ratio

The VTS Performance Score is my own designed metric to measure the rate of return of an investment in relation to the most direct pain...

Brent Osachoff

Jan 30, 20221 min read

Article #634) 4 Types of Drawdowns and Their Root Cause

VTS Community, With the S&P 500 down over 7% from its highs and the Nasdaq down about 11%, we also find ourselves in an uncomfortable...

Brent Osachoff

Jan 21, 20228 min read

Video #174) Correlation - Build a Strong Investment Portfolio - Volatility Lingo Ep.6

Many investors (and advisors) make the mistake of thinking that a portfolio of assets that "sound different" means that's its...

Brent Osachoff

Jan 18, 20221 min read

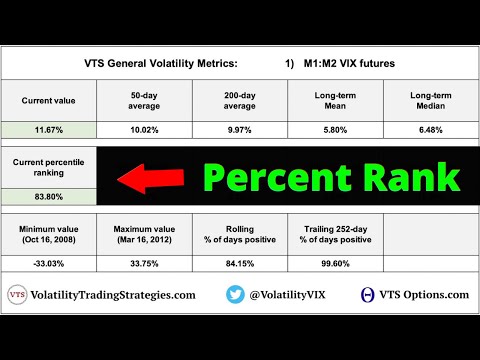

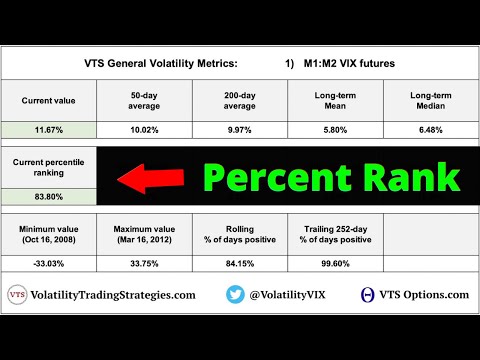

Video #173) Percent Rank - How Traders Must View Volatility Metrics - Volatility Lingo Ep.5

When analyzing data to generate trade signals, absolute or nominal values mean very little on their own. A VIX index of 15 for example...

Brent Osachoff

Jan 9, 20221 min read

Article #633) Tactical Volatility on hold, Aggressive Vol will take the lead

VTS Community, As we've talked about throughout this week, there are very few functional changes to the portfolio to start 2022. Most of...

Brent Osachoff

Jan 7, 20226 min read

VTS Livestream #31) VIX Options Trades - Minimalism in 2022

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Dec 31, 20211 min read

VTS Livestream #30) Are Volatility Spikes More Common? Going From Amateur to Professional

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Dec 24, 20211 min read

VTS Livestream #29) How to Fade VIX Spikes - 3 Best and 3 Worst Ways to Trade VIX

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Dec 3, 20211 min read

VTS Livestream #28) Huge VIX Spike! - Comparing VXX Options vs SVXY

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Nov 27, 20211 min read

VTS Livestream #27) VXX Decay Factor - How to Find Your Perfect Career?

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Nov 20, 20211 min read

Article #632) Part 5 - VB Threshold strategy through the 2020 pandemic

VTS Community, Continuing on with the discussion on VTS strategies during the pandemic, we'll talk about what could be considered the...

Brent Osachoff

Nov 15, 20216 min read

VTS Livestream #26) VXX Broken Wing Butterflies - Scaling, Allocation

Want to join the Awesome VTS Community? * All information, analysis, and articles on this site are provided for informational purposes...

Brent Osachoff

Nov 12, 20211 min read

Video #172) Retire a Millionaire making a 12% a year return

So many people are under the false impression that you need some exorbitantly high rate of return to retire a millionaire. The truth is,...

Brent Osachoff

Nov 10, 20211 min read

bottom of page