top of page

Volatility Trading Strategies

Search

Video #110) Full Time Trading is not smart - Don't go bankrupt!

I see so many people out there expressing a desire to be a full time trader, as if it's some kind of ideal lifestyle or something. In...

Brent Osachoff

Apr 12, 20201 min read

Video #109) 4 ways to beat the upcoming "Employment Crisis"

We are facing an unprecedented slowdown in the global economy, and unfortunately many people are losing their jobs. It's tragic, it's...

Brent Osachoff

Apr 2, 20201 min read

Video #108) 2 ways to Short the VIX

VTS Community, The VIX index is currently as high as it was during the financial crisis in 2008, but we know at some point it will come...

Brent Osachoff

Mar 29, 20201 min read

Brent Osachoff

Mar 23, 20201 min read

Video #106) Awesome Stock Market Indicator - Cash VIX Term Structure

In this video I break down what the Cash VIX Term Structure is, and how it can potentially be used to time the stock market, both good...

Brent Osachoff

Mar 23, 20201 min read

Video #105) How to tell if the Crash is over? VIX Futures Term Structure

Market crashes can be very scary, but they can also prove to be great buying opportunities for those who identify when the selling...

Brent Osachoff

Mar 23, 20201 min read

Video #104) Short Volatility got Crushed! - Here's a better way to do it

I'm always warning traders of the dangers of shorting volatility by directly taking short positions in the long volatility ETPs such as...

Brent Osachoff

Mar 16, 20201 min read

Video #103) Short VXX vs 3x Long Stocks - Which is better?

Volatility has spiked to the highest level since the 08' financial crisis. There may be a few brave people out there looking to time a...

Brent Osachoff

Mar 12, 20201 min read

Video #102) 12 x 30 day Challenges for 2020!

Every month this year I'm going to do a different 30-day challenge. Personal finance, Career, Health, Relationships, there's a little of...

Brent Osachoff

Jan 6, 20201 min read

Video #101) VXX Puts vs Short VXX - Which Short Volatility method is better?

I've said many, many times (like broken record amount of times) that I don't believe anybody should ever short volatility ETPs directly...

Brent Osachoff

Dec 22, 20191 min read

Video #100) A New Short Volatility ETP? SVIX - The New XIV

All volatility traders know about the unfortunate demise of the old XIV, so this news of a potential new -1x inverse volatility ETP is...

Brent Osachoff

Dec 13, 20191 min read

Video #99) 4 Ways to Short Volatility - Ranked from Worst to Best

Shorting Volatility has become quite mainstream in the last few years, but the thing is, not all short volatility strategies are the same....

Brent Osachoff

Dec 11, 20191 min read

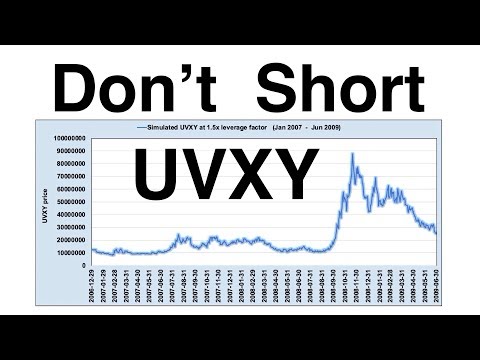

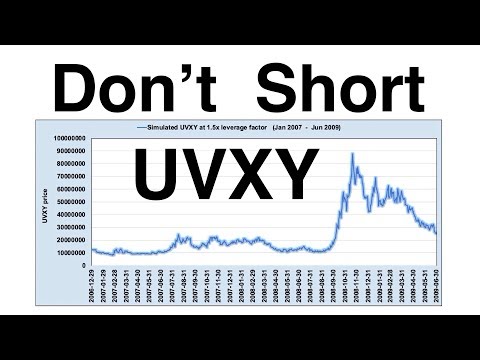

Video #98) Don't Short UVXY

There are many ways to trade the various volatility ETPs on the market, some of which can be quite profitable and reasonably safe. ...

Brent Osachoff

Dec 2, 20191 min read

Video #97) Constant Portfolio Rebalancing for Active Traders

In this final part 3 of the portfolio rebalancing series, I'll go over how I regularly rebalance my own portfolio which is more active...

Brent Osachoff

Dec 1, 20191 min read

Video #96) "How to" Rebalance a Portfolio

There's three common methods of portfolio rebalancing depending on the structure and preference of the investor. In this video I'll talk...

Brent Osachoff

Nov 25, 20191 min read

Video #95) "Why" Portfolio Rebalancing is so important

Portfolio rebalancing is a vital component of proper risk management, but unfortunately many investors don't implement it. This can...

Brent Osachoff

Nov 21, 20191 min read

Video #94) Can VIX Futures Predict Recession?

With so much recession talk lately, as a volatility specialist I thought I would share a VIX futures specific metric that I use that may...

Brent Osachoff

Nov 17, 20191 min read

Video #93) Why VIX futures roll yield is SO important - VXX trading

VTS Community, I've got a video today talking about a vital concept for anyone trying to understand how the volatility ETPs like VXX,...

Brent Osachoff

Oct 23, 20191 min read

Video #92) VB Threshold replacements part 5: Low volatility 0 - 20% range

Making a profit trading when market volatility is in its extreme low range is actually a lot harder than many investors realize. In this...

Brent Osachoff

Sep 16, 20191 min read

Video #91) Is it realistic to be a full time trader for a living? Day trading?

I get this question all the time, and I see it asked every week on Twitter and in Facebook groups, so I thought I would tackle it...

Brent Osachoff

Sep 12, 20191 min read

bottom of page